Being in debt can feel overwhelming, but getting out of it is possible with the right strategy. Whether you’re drowning in credit card debt, student loans, or personal loans, taking control of your finances is the first step toward financial freedom. Let’s explore two of the most effective methods—Debt Snowball and Debt Avalanche—and how you can become debt-free in just six months.

Understanding the Debt Snowball Method

The Debt Snowball method, popularized by Dave Ramsey, focuses on paying off your smallest debts first while making minimum payments on the rest. Here’s how it works:

- List all your debts from smallest to largest, regardless of interest rates.

- Pay the minimum amount on all debts except the smallest one.

- Throw every extra dollar at the smallest debt until it’s paid off.

- Move to the next smallest debt and repeat the process.

Why It Works: The psychological boost of clearing small debts quickly keeps you motivated. This method is great for people who need quick wins to stay committed.

Understanding the Debt Avalanche Method

The Debt Avalanche method focuses on minimizing interest costs by paying off the debt with the highest interest rate first. Here’s how to do it:

- List all debts from the highest to lowest interest rate.

- Pay the minimum amount on all debts except the one with the highest interest rate.

- Allocate as much extra money as possible toward the high-interest debt.

- Once that debt is cleared, move to the next highest interest rate debt.

Why It Works: This method helps you save the most money on interest, making it the most mathematically efficient way to get out of debt.

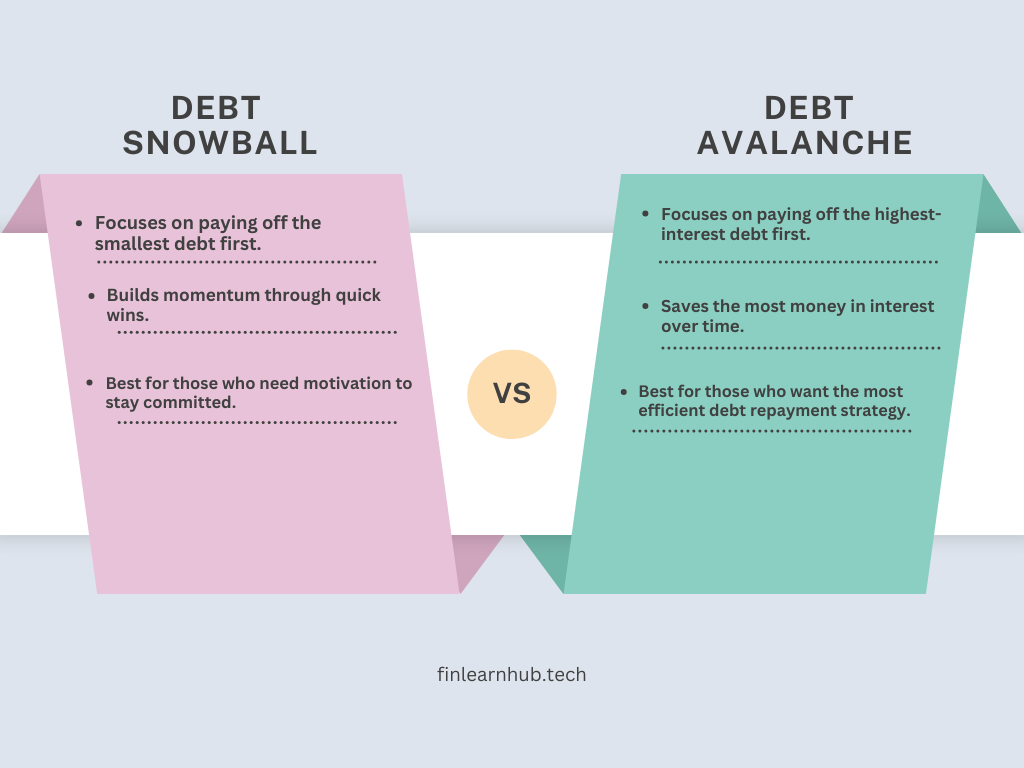

Debt Snowball vs. Debt Avalanche: Which One is Better?

The best method depends on your financial mindset:

- Choose Debt Snowball if you need quick wins to stay motivated.

- Choose Debt Avalanche if you want to save the most money in the long run.

If you struggle with staying disciplined, the Debt Snowball method might be more effective. However, if you’re focused on minimizing overall costs, the Debt Avalanche method is the better choice.

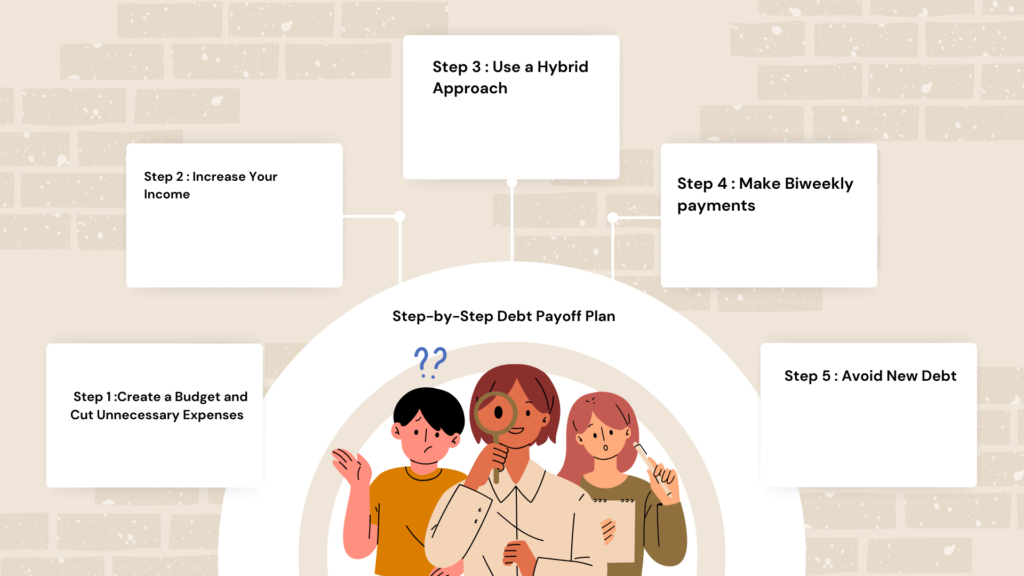

How to Become Debt-Free in 6 Months

If you’re serious about getting out of debt fast, follow these actionable steps:

1. Create a Budget and Cut Unnecessary Expenses

Track your income and expenses to identify areas where you can cut back. Cancel unused subscriptions, cook at home, and minimize impulse spending.

2. Increase Your Income

Consider side hustles, freelancing, or selling unused items to generate extra cash for debt repayment.

3. Use a Hybrid Approach

If six months is your goal, consider a mix of Debt Snowball and Debt Avalanche. Start by paying off a small debt for motivation, then switch to the highest-interest debt.

4. Make Biweekly Payments

Instead of paying monthly, make biweekly payments. This small trick can reduce interest and help you pay off debt faster.

5. Avoid New Debt

While paying off existing debt, avoid taking on new debt by using cash or debit cards instead of credit.

Final Thoughts

Getting out of debt isn’t easy, but it’s entirely possible with commitment and the right strategy. Whether you choose Debt Snowball or Debt Avalanche, the key is consistency. Take control of your finances today, and in just six months, you could be living a debt-free life!

Need more personal finance tips? Stay tuned for more insights on managing money wisely!